Enhancing Your Trading Experience with Metatrader 4 Add-Ons

Automated trading has been around since the inception of trading. Over the years, this method of trading has been growing in popularity due to its many benefits. With technological advancement, automated trading has become much more sophisticated and accessible to traders of all levels. Metatrader 4 is one of the most popular trading platforms that supports automated trading, and it is used by millions of traders worldwide. In this blog post, we will explore the basics of making money with automated trading on Metatrader 4 platforms.

1. Understanding Automated Trading:

Automated trading, also known as algorithmic trading or robo-trading, is a method of trading where a computer program executes your trades automatically based on predefined criteria. Through automated trading, you can easily automate complex trading strategies which otherwise would take hours or even days to execute manually. To get started with automated trading, you need to have a clear understanding of the trading strategy you want to implement. This could be anything from a simple trend-following strategy to a complex multi-layered strategy based on machine learning algorithms.

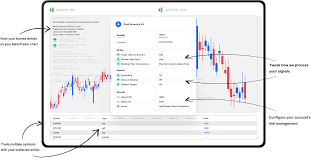

2. Setting up Metatrader 4:

Setting up metatrader 4 for automated trading is easy and straightforward. All you need is a computer, an internet connection, and a trading account with a broker that supports Metatrader 4. Once you have set up your trading account, you can download and install the Metatrader 4 platform from the broker’s website. After installation, you can log in to your account and start building your automated trading strategy. Metatrader 4 offers a wide range of tools that you can use to create and test your strategies before implementing them.

3. Building a Trading Strategy:

Building a profitable trading strategy requires a blend of technical analysis, fundamental analysis, and risk management. In automated trading, the strategy should be programmed using a trading language called MQL4, which is similar to C++. Through MQL4, you can create custom indicators, scripts, and expert advisors (EAs) that define your trading strategy. EAs are the backbone of automated trading and can execute trades based on predefined rules. When developing your trading strategy, ensure that you test it thoroughly using historical data to ensure that it works in different market conditions.

4. Risk Management:

Automated trading can be risky if proper risk management is not used. One of the most common mistakes that traders make is over-optimization, which involves curve-fitting your strategy to historical data to achieve maximum profits. This can lead to catastrophic losses if the market conditions change. To avoid this, you should use risk management techniques that limit your exposure to the market. This includes setting stop-losses, take-profit levels, and limiting the number of trades per day or week.

5. Choosing a Broker:

Choosing a reliable broker is essential when it comes to automated trading. You need a broker that offers tight spreads, fast trade execution, and minimal slippage. Moreover, the broker should have a robust infrastructure that ensures maximum uptime, and customer support should be readily available to assist you when needed. When selecting a broker, ensure that they support Metatrader4 and that they offer reasonable commission rates

Conclusion:

Automated trading is a game-changer for traders who want to automate their trading strategies and make money while they sleep. By using Metatrader 4, you can easily implement your strategy and enjoy the many benefits of automated trading. However, a critical aspect of automated trading is proper risk management, which involves limiting your exposure to the market. By choosing a reliable broker and testing your strategy thoroughly before implementation, you can expect success in automated trading.